After the form is fully gone, media Completed.Place an electronic digital unique in your UK DVLA D1 by using Sign Device.Navigate to Support area when you have questions or perhaps handle our Assistance team.Very carefully confirm the content of the form as well as grammar along with punctuational.Make sure that you enter correct details and numbers throughout suitable areas.

Use your indications to submit established track record areas.On the site with all the document, click on Begin immediately along with complete for the editor.

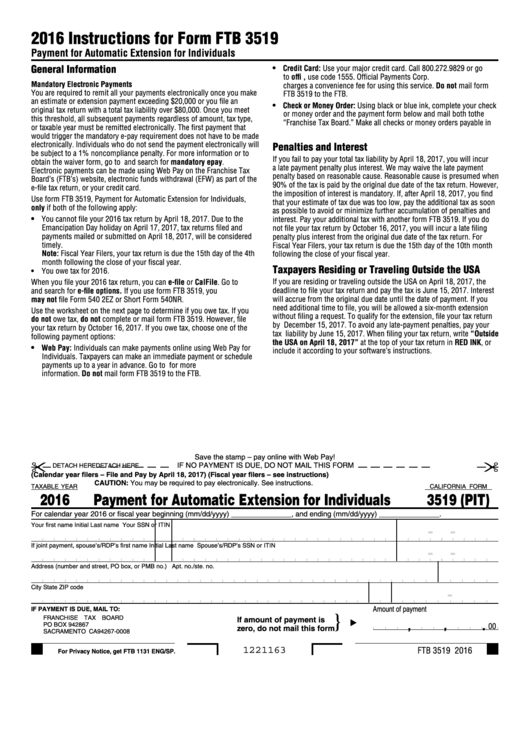

#2016 tax extension form printable how to

Stick to the fast guide to do UK DVLA D1, steer clear of blunders along with furnish it in a timely manner: How to complete any UK DVLA D1 online: 19, depending on where you live), but will then have until oct.Online solutions help you to manage your record administration along with raise the efficiency of the workflows. On march 17, 2021, the irs officially extended the federal income tax filing deadline from april 15 to may 17. Hmrc extend filing deadline for 20/21 tax returns to february 2022 hmrc have announced an extension to the january 31st filing deadline for personal tax returns. In Case You’re Just Somewhat Finished With Your Tax Returns And Need More Opportunity To Record, At That Point A Tax Extension Could Be The Ticket For You. In normal years you have until 31 january to file your tax return, but this year the taxman. What Is Personal Tax Extension Form 4868. Efile irs form 4868 (application for automatic extension of time to file u.s. Will there be another deadline extension? Tax season is upon us and this year there won't be any deadline extensions. See also 2022 New England Patriots Draft Picks Anyone Who Cannot File Their Return By The 31 January Deadline Will Not Receive A Late Filing Penalty If. This will be a welcome announcement for many agents due to recent staffing issues driven by the number of covid cases this last month.

The federal income tax filing deadline is april 18. The Personal Tax Extension Form (Known As The “Application For Automatic Extension Of Time To File U.s. The actual deadline to file personal tax extension form 4868 is april 15. Extensions may be granted (extending the filing deadline through april 18) for good cause, upon written request, filed no later than jan. However, there are some important considerations for state taxes, estimated taxes and certain taxpayers. Extension Form 4868 Usually Allows Taxpayers To Extend Their Personal Income Tax Return Deadlines Up To Six Months. When is the tax extension deadline? The actual deadline to file personal tax extension form 4868 is april 15. See also Mountain View California Minimum Wage 2022įor the 2020 tax year, form 1040 is due on may 17, 2021. What is personal tax extension form 4868.

However, for the second year running, hm revenue & customs (hmrc) is waiving late. The penalty waivers will mean that: Anyone who cannot file their return by the 31 january deadline will not receive a late filing penalty if. Possible ITR deadline extension and filing reminders from Taxpayers have to request an extension by apr. 15 deadline approaches for taxpayers who requested extensions to file 2020 tax returns.

0 kommentar(er)

0 kommentar(er)